Understanding the Vehicle Insurance Stack:

Sep 9, 2024

Let’s say someone is driving for personal reasons and gets into an accident. That falls under their Personal Auto policy. Easy enough.

Now, let’s say that driver is an independent contractor performing deliveries for a company while out delivering a catering order they get into an auto accident. How does that shake out?

It depends. In the unlikely event the driver has a Personal Auto policy that doesn’t exclude coverage for business use (a rarity these days), that driver’s Personal Auto policy would be the first line of defense.

But let’s assume that the driver’s Personal Auto insurance excludes business use. In that case, the next question to ask is was there Commercial Auto coverage?

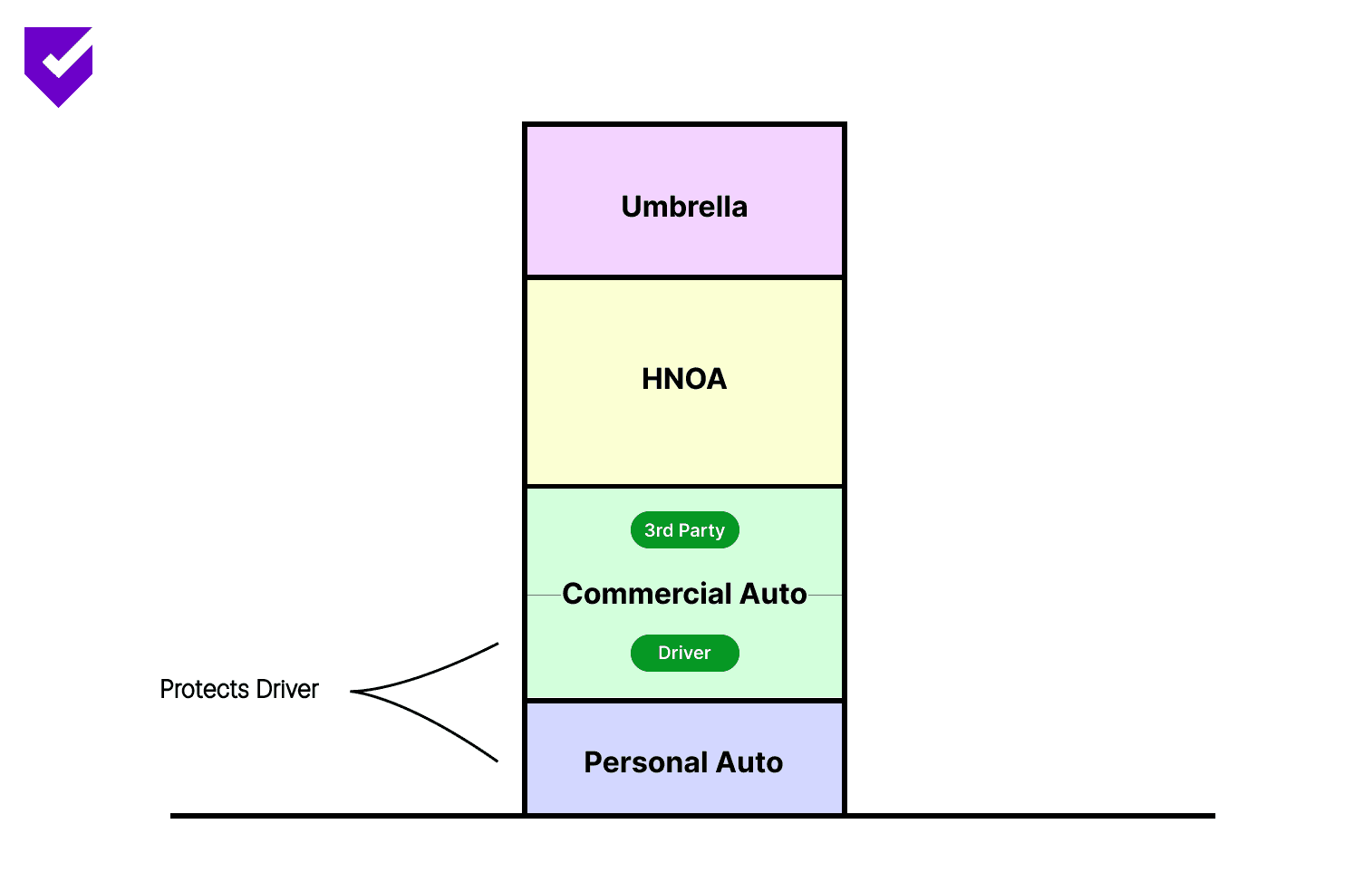

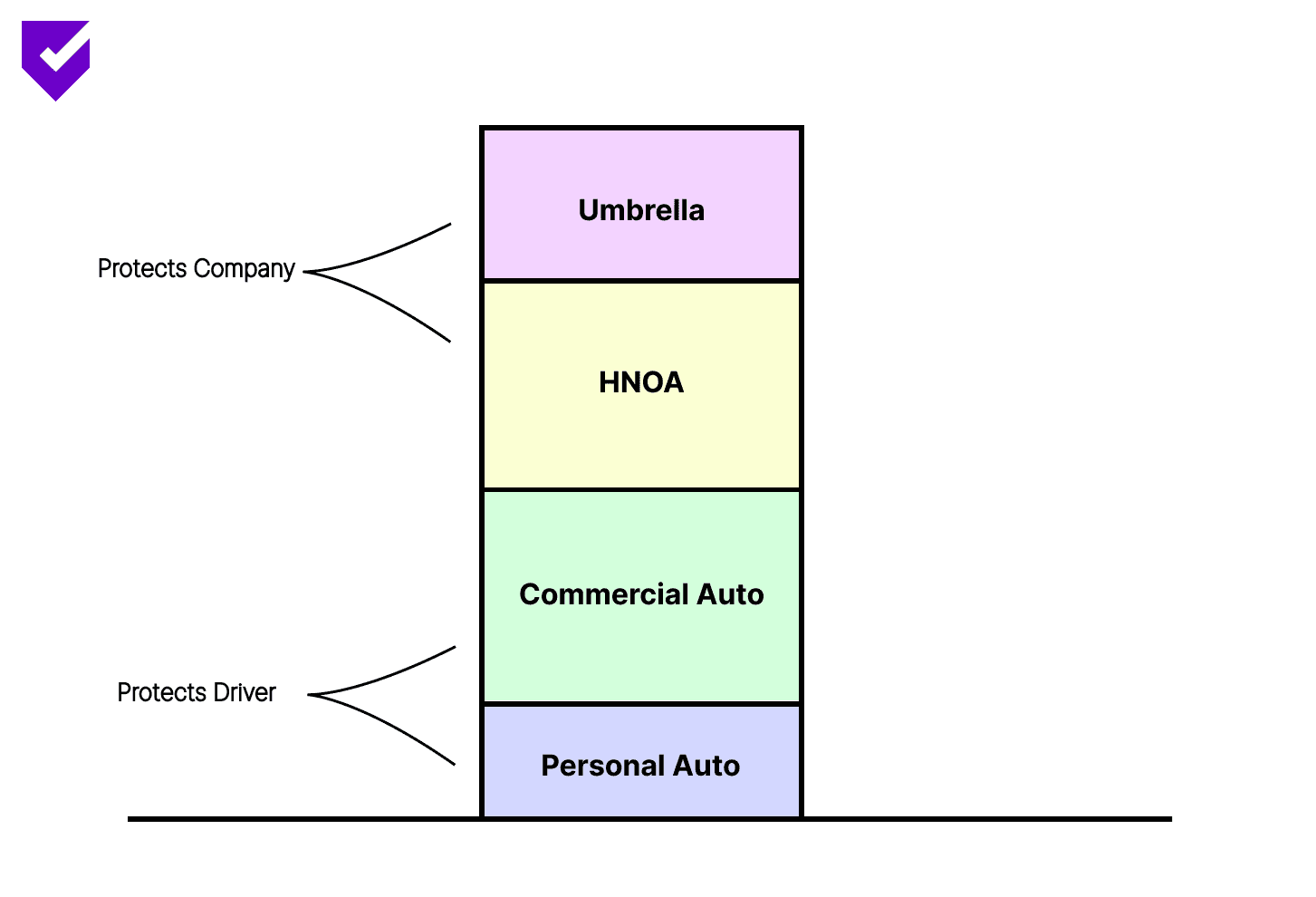

Commercial Auto provides coverage for accidents that occur while driving for work, covering things like third party vehicle damage and medical/legal bills involved in a work related accident. This coverage protects the driver. Crucially, some policies cover both the independent contractor’s vehicle and third party liability, while others only cover third party liability.

It’s possible for either the independent contractor to bring this insurance themselves (the larger the vehicle the more common this is) or for the contracting company to provide/require the coverage.

Since it’s unusual for an independent contractor to be able to afford Commercial Auto when using their personal vehicle for deliveries (requesting this add on to their personal plan can raise their monthly rate by hundreds of dollars), for our purposes we have the following two scenarios:

The company acquires a Commercial Auto policy that extends to their contractors (costs can be fully passed on, split, or fully absorbed)

There is no Commercial Auto coverage

Put a pin in this divide as we’ll be coming back to Commercial Auto. But so far, so good. These bottom two layers directly protect the driver. Let’s keep moving up the stack.

Protection for the Delivery Company

Above Commercial Auto lies Hired & Non-Owned Auto (HNOA) coverage, and that’s coverage paid by and specifically for a delivery business. Even though the business doesn’t own the vehicles, it can still be held liable if one of these vehicles is involved in an accident while being used for business purposes (aka a “non-owned auto”).

So let’s say a driver’s personal auto plan has no work related addendum and let’s say there is no Commercial Auto, or that a contractor does get into an accident but the third party decides the delivery company bears some responsibility for the accident. That’s where HNOA comes in, specifically protecting the delivery company.

Lastly, there’s the humble umbrella policy. For our purposes, an umbrella policy simply lets a delivery company buy additional liability coverage for a given price. Think of this as like buying extra fries with your McDonald’s Happy Meal. Sure, the meal already comes with lots of good stuff (fries, drink, nuggets, toy), but if you really want more fries (read auto liability protection) you can just order more.

These top two layers serve to protect the delivery company.

Would You Like Fries With That?

Enough theory, let’s run through an example. Check out the image below, this time with specific coverage details for each layer in the stack.

In this scenario,

The driver’s Personal Auto plan doesn’t cover accidents while on the job.

The company mandates that drivers carry Commercial Auto, either through their own partner while onboarding or demonstrating proof of already having obtained such insurance. This particular policy doesn’t protect the driver, but does protect against third party liability (up to $300k per party and up to $500k per accident, “$300k/$500k”)

Sitting above is the company’s HNOA policy of $1.5m in coverage.

And perhaps out of an over abundance of caution, this company’s owner has decided to carry an umbrella for $5m of extra coverage.

Now for some minor chaos. Say a driver is contracted by the company to complete a catering order, and on the way to the customer this driver gets into a fender bender. The driver’s vehicle is damaged ($10k) and the vehicle of the other party is damaged ($15k).

During discovery the other party and the driver’s personal auto plan provider become aware that the accident occurred while the independent contractor was working for the delivery company, thus outside of their personal auto plan.

But galloping to the driver’s defense comes their Commercial Auto policy. Although the driver is still out of luck regarding their own vehicle damage, the third party damages are well within their $300k/$500k Commercial Auto coverage policy.

This is one of the secondary benefits when drivers carry Commercial Auto: for smaller claims they may protect a company’s HNOA policy from being dragged into the mix.

And it’s a good thing this company’s HNOA policy has been resting up, because it’s about to see some serious action.

Say a driver is contracted by the company to complete a catering order, and on the way the driver gets in a major accident. The driver’s vehicle is totalled ($25k), the driver has medical bills ($5k), the third party’s vehicle is totalled ($35k), and there are third party medical bills ($150k). Worse still, in the following investigation the third party concludes that the company is liable for the accident - perhaps the driver was fatigued from excessive work and they blame the company’s personnel policy or the driver was talking to dispatch during the accident and they blame company safety protocol, etc. - and decides to go after the delivery company for damages (or they may simply want to sue for more than what the Commercial Auto policy will cover, $300k/$500k).

The resulting legal fees cost both sides $250k. And although we’re already in rare territory, let’s continue with the unfortunate scenario where the company ends up losing in court and is responsible for an additional $2m in damages to the affected third party.

We now have $500k in legal fees (including the opposition), $30k in costs borne by the driver, and $2m in damages to the third party.

Note that under this Commercial Auto policy the driver has no protection for vehicle damage (although they might qualify for compensation for their injuries under an Occupational Accident policy).

Let’s total up the bill:

Third party vehicle : $35k

Third party medical: $150k

Legal fees: $500k

Third party liability: $2.0m

Total: $2.685m

The Commercial Auto policy would be hit first (covers up to $500K per accident), absorbing the $35k + $150k. It would also begin to make a dent in the legal bills by covering those associated with this portion of the claim. Let’s say of the $500k in legal fees, $50k are associated with settling the third party vehicle and medical liability under the Commercial Auto policy. We’re now down to $450k in outstanding legal fees.

So the delivery company is now left with $2.45m in total ($450k in legal fees and $2m in damages). This maxes out the HNOA policy and goes $450k into their umbrella policy.

Looks like this owner is glad they ordered extra fries with that Happy Meal.

Download PDF Book