Why Are Insurance Rates Rising?

Sep 9, 2024

“A nickel ain’t worth a dime anymore.”

- Yogi Berra

Insurance might be one of the most frustrating costs to control in your business, particularly if you’re a company on the smaller side. Routes can be changed, underperforming staff and unprofitable clients can be cut, but when it comes to the price of your coverage we’re all pretty much just price takers.

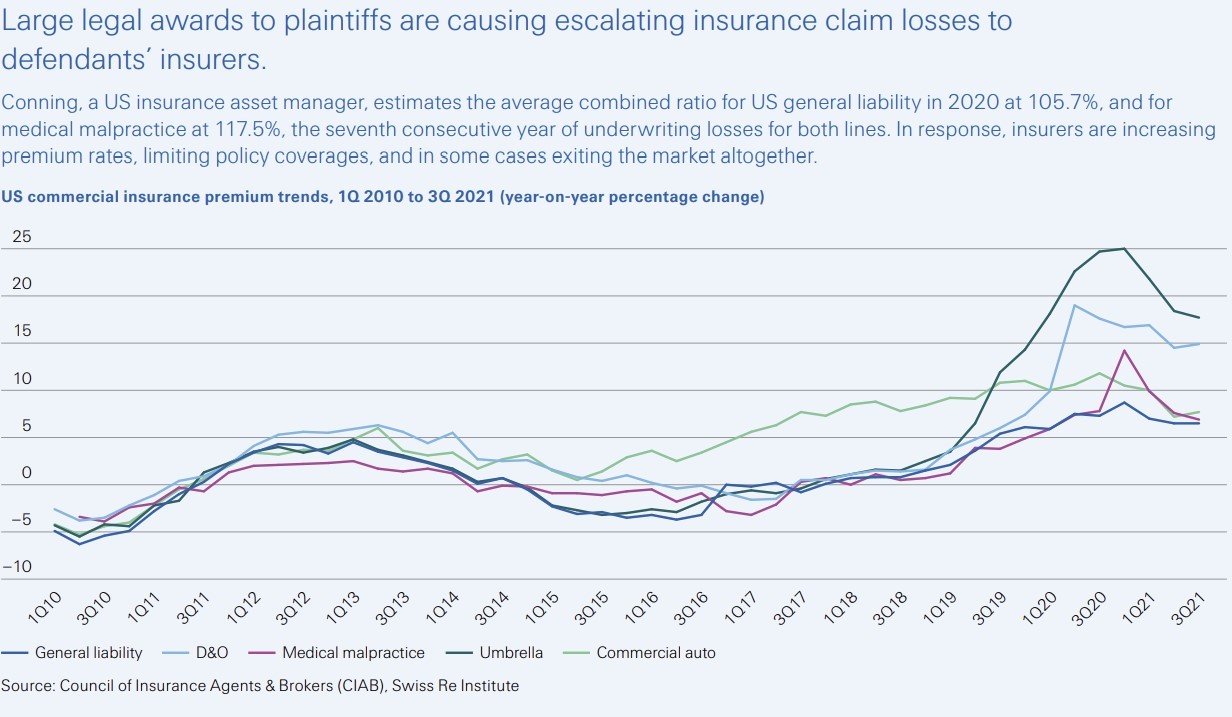

As underwriting profits deteriorate for insurance companies on certain lines of coverage, rates are on the rise. And we’re guessing this isn’t news to anybody reading this report.

Take commercial auto insurance for example. Since 2012 rates hikes have generally outperformed every other line of coverage. And potentially worse news still: over the past 10 years commercial auto rates have lagged inflation, meaning they just might have some continued catching up to do in the foreseeable future.

So, why are rates climbing? Let’s dive deeper into the major drivers: rising social inflation and the cloak and dagger machinations of something called Third Party Litigation Finance.

Part One: Social Inflation

Veteran insurance analyst Christopher Graham of AM Best lays it out as follows:

The liability component has been more problematic than the physical damage component, which is no surprise since adverse loss reserve development, driven by social inflation, tends to be a bigger issue for liability claims, which generally have a longer tail than property damage claims. Even with that, though, the physical damage combined ratio is deteriorating.[1]

Let’s break that down.

When Graham says “the liability component has been more problematic than the physical damage component”, he’s saying that the costs associated with lawsuits, injuries, emotional damage, medical bills, etc. has increased faster than the cost of good ole fashioned car repair.

And if you’ve ever driven down the highway and seen an enormous billboard of a middle aged man bragging about how many billions he’s won his trial clients, you already know this to be the case. Graham notes that liability claims, i.e. the “social” stuff, have a longer loss tail than more humble property claims (totaled vehicles).

Replacing a BMW has a maximum cost that is fairly well understood. But losing an injury case to that guy on the billboard… Graham is saying that over the past 10 years the price of that has risen substantially. That’s “social inflation”.

Commercial Insurance (‘99-’24)[2]

Motor Vehicle Insurance (Bureau of Labor Statistics)[3]

Part Two: The TPLF Industry and LFCs

There’s proximate causes, and then there’s ultimate causes. Social inflation is a (large) cause of insurance price hikes, but we’re still left with the following question: what exactly has driven the causes of rising “social” costs sky high in the past decade?

Enter, stage right, Third-Party Litigation Finance and Litigation Funding Companies.[4]

If you ever want to dress up as something scary for Halloween, try trick or treating as a Litigation Funding Company (LFC). The kids might not get it, but it should scare the daylights out of your insurance company.

Here’s the TL;DR on TPFL and LFCs from the folks at the Swiss Re Institute:

[Third-Party Litigation Finance] involves a third party financing the legal representation of a party in a case. This is an alternative to the party self-funding or using a contingent or conditional fee agreement, in which they only pay lawyers’ fees if their claim is successful… Funding agreements are directly between the [Litigation Funding Company] and the plaintiff or a law firm, but funding can be obtained through a litigation funding broker… Commercial cases and mass torts with large potential awards are their main areas of focus, particularly for large funding companies. However, LFCs also support individual personal injury claims. [5]

That’s complicated, so let’s break it down.

Since 2000, there’s been the massive growth of a new industry that funds lawsuits in pursuit of superior returns. That industry is called Third-Party Litigation Finance (TPLF), and the companies that put up the capital are called Litigation Funding Companies (LFCs). Essentially, they’ve spotted a legal arbitrage and have turned it into a financial arbitrage, generating superior returns by funding increased levels of lawfare and sharing in the spoils.

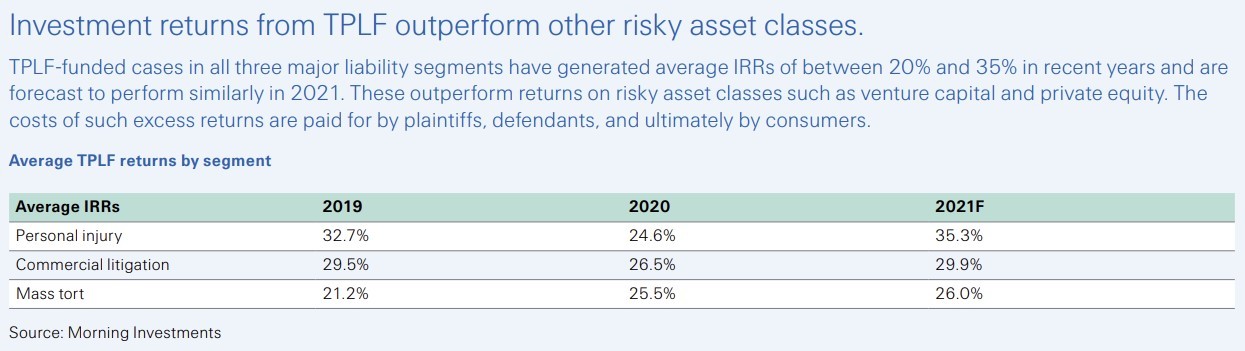

And the returns have been stellar indeed, even outperforming certain stalwarts like venture capital and private equity.

Naturally, as the insurance companies on the other side of these cases tally up their losses, such costs get passed down the line to the end customer - you.

If you’ve been hearing the phrase “nuclear verdict” more and more lately, you can literally see the effect.

Since 2010, among cases with payouts greater than $1m the percentage of $5m+ payouts for general liability cases has increased from 29% to 37%. For vehicle negligence cases it’s gone from 22% to 29% over the same period. The median award for cases at $1m+ as also become unmoored, ballooning from $8.2m in 2010 to $10.3m in 2019 (25.6% increase).

And that’s just when we spotlight large awards. When viewing a three year moving average from 2009-2019, general liability awards have increased a staggering 224%.[9]

Honestly, it’s a brilliant financial strategy. It’s just a shame that we’re on the other side of the trade.

Download PDF Book